Recent Articles

Hey Hues! 2013 Carpet Colors and Patterns Trending Now

by Beth Herman Though most of us don’t have a significant other who (ahem) bids us to sleep on a bed of roses, or lays a carpet of the world’s [...]

In Other News …

Donald Trump Talks Old Post Office, DC Hotels [Washington City Paper] The Donald said a bunch of stuff on various subjects but no one in attendance heard a single word, [...]

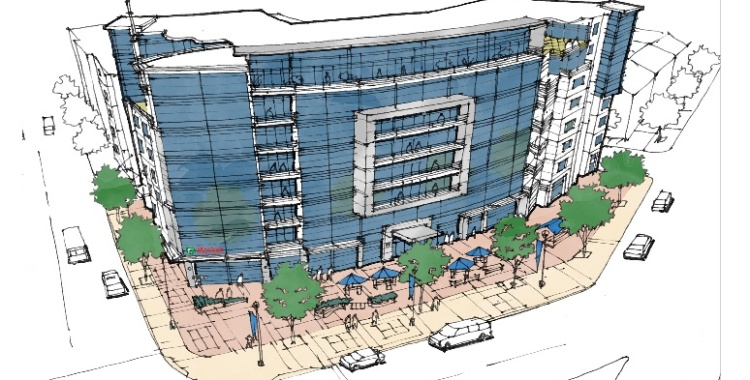

Camden South Capitol unveiled in SW D.C.

A new 276-unit residential building right across from Washington Nationals stadium is now complete. Camden Property Trust unveiled its first DC development project, Camden South Capitol, on Wednesday. The 386,612 [...]